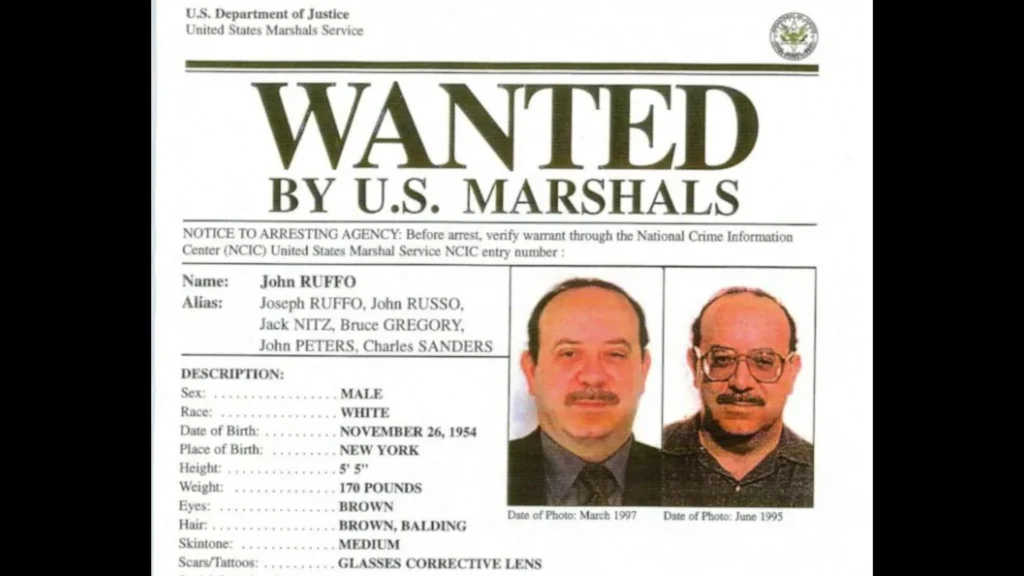

John Ruffo, a once-ordinary Brooklyn native and computer salesman became one of the most elusive white-collar criminals in American history. Behind a desk and beneath a composed demeanor, he orchestrated a staggering $350 million bank fraud—one of the largest in U.S. history. His deception was so elaborate that decades later, law enforcement is still trying to track him down.

The Birth of a Scheme

In the early 1990s Ruffo crossed paths with Edward J. Reiners, a former high-ranking executive at Philip Morris USA. Recently laid off, Reiners had the background and corporate ties that would prove vital to their con. The duo devised a fake venture—code-named Project Star—claiming it was a secret initiative funded by Philip Morris to develop smokeless cigarettes, per Oxygen.

Ruffo’s firm, Consolidated Computer Services (CCS) was presented as the contractor responsible for supplying computers and consulting services for the phantom project’s operations across five international offices. With forged documents, fabricated corporate seals and executive signatures—they built an image of credibility. Reiners’ real connections to Philip Morris gave their story just enough authenticity to earn the trust of financial institutions.

They went so far as to include strict confidentiality agreements to prevent banks from reaching out to Philip Morris for verification. According to The New York Times this tactic worked flawlessly at first as banks believed they were financing a breakthrough in tobacco technology.

Discovery and Fallout

The operation began to unravel when a sharp-eyed executive at the Long-Term Credit Bank of Japan noticed inconsistencies in the paperwork. That discovery triggered an internal review and soon, law enforcement stepped in. The investigation uncovered a complicated web of deceit, involving multiple banks both in the U.S. and abroad.

Edward Reiners was arrested first. Ruffo was indicted shortly after, facing a 150-count federal charge including wire fraud, conspiracy, money laundering and bank fraud. Much of the stolen money had already been squandered on risky stock ventures and an extravagant lifestyle. Authorities were never able to recover approximately $21 million of the stolen funds.

Former Deputy U.S. Marshal Barry Boright told ABC News, “A pathological liar. He was a fraud guy. Half of everything in his life was a lie.”

A Brilliant Illusion

The mechanics behind the fraud were disturbingly advanced. Ruffo and Reiners forged high-level correspondence and presented themselves as intermediaries for Philip Morris. Banks were persuaded they were supporting a high-tech, confidential product launch, justifying the massive loans. Ruffo even ensured that timely interest payments were made on the loans which helped keep suspicions at bay.

According to The Cinemaholic, banks were led to believe their investments were being used to fund a pioneering tobacco alternative, spread across several international locations. Ruffo’s company appeared fully operational, masking the truth beneath layers of fiction.

A U.S. Marshal assigned to the case later remarked, “You just think about everything we know about him and how much he was able to lie and just kind of live a double life.”

Trial, Sentence—Then Disappearance

Ruffo’s bail was set at $10 million—an unusually high amount due to fears he might flee. Most of his assets were frozen and family members put up their homes to guarantee his appearance in court. Reiners, in contrast, pleaded guilty and cooperated with authorities, providing crucial testimony against Ruffo.

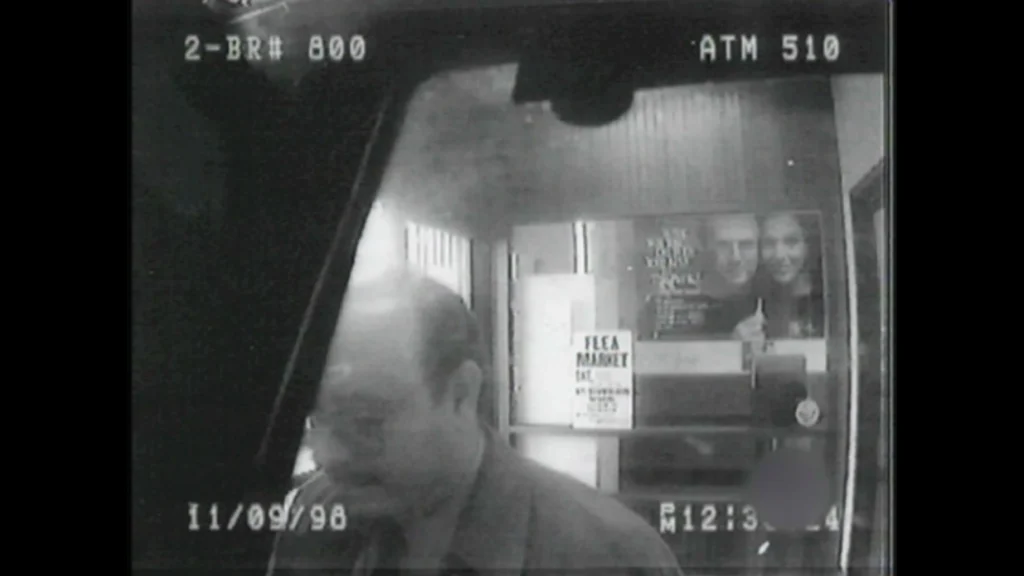

In 1998, Ruffo was convicted on all counts and sentenced to 17 years in federal prison. But just days before he was supposed to report to begin his sentence, Ruffo vanished.

He removed his court-ordered ankle bracelet, withdrew $600 from an ATM and disappeared without a trace. NBC News described it as one of the boldest disappearances in recent history. He has never been found.

The Endless Hunt

Since that day in 1998, the manhunt for John Ruffo has spanned decades and continents. There have been possible sightings, including one intriguing moment in 2016, when a man believed to be Ruffo was spotted at a Dodgers game in Los Angeles, per New York Post.

Speculation surrounds his disappearance. Some believe he may be living under a new identity while others suspect ties to organized crime or even involvement in covert government activity. None of these theories have ever been confirmed.

Senior Inspector Chris Leuer of the U.S Marshals Service noted, “We believe he could still be using those skills today to maintain his new identity.”

Financially, the impact on the banks involved was catastrophic. Only a portion of the funds was recovered. Federal agents estimate that Ruffo may still have access to at least $8 million, potentially supporting his life in hiding.

U.S. Marshals Service Director Donald Washington told People, “It only takes one tip for us to catch up with Ruffo. By now, he is likely well established and comfortable in whatever alias he is living under. He could be anywhere on the globe.”

A Legacy of Deceit

John Ruffo’s case not only exposed weaknesses in banking due diligence but also left a lasting scar on the world of financial crime.

The case has been featured in documentaries, podcasts and media investigations, with each retelling adding new intrigue to his mythos. As one analyst succinctly put it, “The story of John Ruffo is incredible, and there are many twists and turns.”

Whether he’s hiding in plain sight or living a life of shadows, one thing is certain: the story of John Ruffo is far from over.